That amount is compounded quarterly for the number of quarters remaining before the end of the three-year period. Think of this as twelve different compound interest calculations, one for each quarter that you deposit $135. At the end of three years, simply add up each compound interest calculation to get your total future value. You plan not to put anything else on the card, and to pay it all off in five years. Even though you’d be chipping away at your balance and paying an extremely low interest rate, you could still end up paying a lot in interest charges — more than $1,000, in fact.

Under simple interest, the principal is multiplied by the interest rate so no compounding occurs. You can give this a try using our compound interest calculator to see the differences when using various methods of compounding. Laura started her career in Finance a decade ago and provides strategic financial management consulting. Use the tables below to copy and paste compound interest formulas you need to make these calculations in a spreadsheet such as Microsoft Excel, Google Sheets and Apple Numbers. Within our compound interest calculator results section, you will see either a RoR or TWR figure appear for your calculation.

Triple Compounding: The Power of Tax-Deferral

The concept of interest is the backbone behind most financial instruments in the world. Number of Years to Grow – The number of years the investment will be held. The conventional approach to retirement planning is fundamentally flawed. It can lead you to underspend and be miserable or overspend and run out of money. This book teaches you how retirement planning really works before it’s too late.

- Calculating compound interest looks complicated, but it’s actually as simple as plugging some numbers into the right formula.

- If the contribution frequency is annual, annual compounding is utilized, again if the annual contribution is set to zero.

- Simple interest tends to be used in most student loans, mortgages, and installment loans — when you’re paying a store for the purchase of a big appliance over a period of time, for example.

- Use the tables below to copy and paste compound interest formulas you need to make these calculations in a spreadsheet such as Microsoft Excel, Google Sheets and Apple Numbers.

This interest is added to the principal, and the sum becomes Derek’s required repayment to the bank one year later. You can look at your loan or credit card disclaimer to figure out if your interest is being compounded and at what rate. Following is the formula for calculating compound interest when time period is specified in years and interest rate in % per annum.

What to do when the Compounding Bases aren’t the Same

For example, say you have $100 in your savings account and it’s paying 10% in simple interest. That means the 10% interest rate applies only to your original principal amount of $100, so you earn $10 each year. At the end of the third year, $130 — compared to $133.10 in the compounded interest account. And if you were being charged 18% compounded daily — which is closer to the average credit card interest rate — you would pay $5,236 in interest after five years.

Let’s again assume that you are depositing $135 quarterly for three years, that compounds at 6%. We still want to know how much money we will have at the end of three years, but what happens if we deposit that money at the beginning of each period? All that happens is that in that three-year period, each deposit accrues interest for one more period. Because you deposit $135 right at the beginning, that amount compounds for all twelve periods, and your last deposit of $135 will have the chance to earn interest for the last period. Let’s say you have $1000 to invest, and you can leave that amount for 5 years. The financial institution where you deposit the money offers you a 10% interest rate, which will be compounded daily.

Through the SmartVestor program, you can connect with up to five of them in your area for free and then decide who you want to work with. Sign up to get updates from MoneyGeek including how to overcome your financial headwinds, hack your finances, and build wealth. Historically, rulers regarded simple interest as legal in most cases. However, certain societies did not grant the same legality to compound interest, which they labeled usury.

After subtracting about 3% inflation the real returns were about 7% a year between 1927 and 2014. Daily Compound Interest is calculated What is the difference between a ledger and a trial balance using the formula given below. For our Interest Calculator, leave the inflation rate at 0 for quick, generalized results.

How much interest do 2 million dollars earn?

You can also see how compounding frequency can impact the total interest earned. Consistent investing over a long period of time can be an effective strategy to accumulate wealth. The Bankrate Compound Interest Calculator demonstrates how to put this savings strategy to work. Calculate the future value of an investment or debt where the principal is compounded daily. Enter the initial value, interest rate, and time period in days to find it. After 10 years of compounding, you would have earned a total of $4,918 in interest.

Let’s say you invest $1,000 in an account that pays 4% interest compounded annually. In order to calculate the future value of our $1,000, we must add interest to our present value. Because we are compounding interest, we must reinvest our interest earned so that our interest earned also earns interest.

What is Daily Compound Interest Formula?

The compound interest definition is earning interest on your original money and the money you save. Because interest compounds, the accrued interest allows your savings to grow faster. While only $0.53 in interest was gained by compounding daily, this is essentially free money that is earned because of more frequent compounding. Also, as the principal value gets larger and the time horizon gets longer, this amount will start to add up. Use the prior assumptions of an initial value of $1,000 and 200 days, and now set the interest rate to “annual” and 10.95%.

Let’s take a look at what to do when the rate given is not the rate per compound period. For your convenience current savings rates for high-interest savings, money market accounts and CDs are published below the calculator. The MoneyGeek compound interest calculator uses a pie chart to show you the initial amount you contributed in purple, the total interest you earned in green and your total contributions in blue. For example, $100 with a fixed rate of return of 8% will take approximately nine (72 / 8) years to grow to $200. Bear in mind that “8” denotes 8%, and users should avoid converting it to decimal form.

If you want to know how much interest your investment will earn, our compound interest calculator can help. Contact us today to request a service quote or learn more about our products and solutions. In an account that pays compound interest, such as a standard savings account, the return gets added to the original principal at the end of every compounding period, typically daily or monthly. Each time interest is calculated and added to the account, it results in a larger balance.

Compound Interest (Rate) Calculator

We’ll also explore the benefits of a compound interest rate, including its long-term effect on your savings account or investment portfolio. In reality, investment returns will vary year to year and even day to day. In the short term, riskier investments such as stocks or stock mutual funds may actually lose value. But over a long time horizon, history shows that a diversified growth portfolio can return an average of 6% annually. Investment returns are typically shown at an annual rate of return.

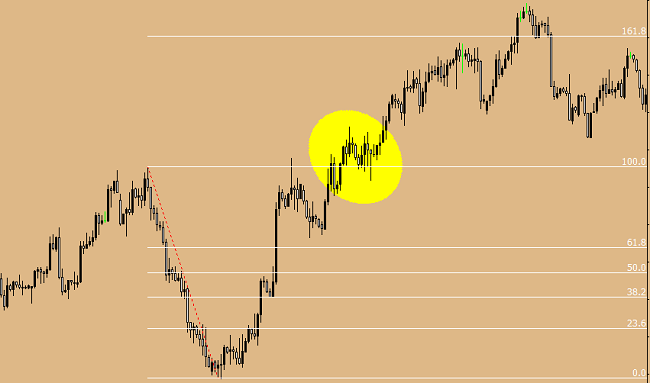

There is little difference during the beginning between all frequencies, but over time they slowly start to diverge. This is the power of compound interest everyone likes to talk about, illustrated in a concise graph. The continuous compound will always have the highest return due to its use of the mathematical limit of the frequency of compounding that can occur within a specified time period. The first part of the equation calculates compounded monthly interest. The second part of the equation calculates simple interest on any additional days beyond the number of months.

If you are investing your money, rather than saving it in fixed rate accounts,

the reality is that returns on investments will vary year on year due to fluctuations caused by economic factors. Daily compound interest is calculated using a simplified version of the formula for compound interest. To begin your calculation, take your daily interest rate and add 1 to it. Next, raise that figure to the power of the number of days it will be compounded for. Subtract the starting balance from your total if you want just the interest figure.

When there’s compound interest, the money you earn each year is added to the money you already have. So, instead of just growing, the accumulated interest grows at an increasing rate which helps save for retirement or invest in stocks. Compound interest also accounts for the effects of inflation and repaying debt.